From fluctuating mortgage rates to resilient regional markets, here’s what 2025 taught us – and what it means for your move in 2026.

National Snapshot

The UK housing market in 2025 has been one of steady but modest growth, characterised by slowing inflation in house prices and a cautious buyer environment

.

According to the Office for National Statistics (ONS), average UK house prices rose by about 3.5 % in the 12 months to April 2025, reaching approximately £265,000.

In England, for example, the annual price rise in June 2025 was about 3.3 %, with an average value of around £291,000.

The North West region (including Bolton & Bury) recorded stronger-than-average growth – around 5 % year-on-year by June 2025.

Other national pressures included elevated interest rates, rising energy and living costs, and a continuing shortage of new-build supply. Many buyers and sellers adopted a “wait-and-see” attitude, moderating movement despite underlying demand.

Key takeaway: Growth remained positive, but the pace slowed compared with the peaks of recent years. The market has shifted into a more balanced phase rather than one of rapid escalation.

Local Focus – Bolton Stand-Out Stats

The average house price in Bolton in August 2025 was around £197,000, up roughly 3.4 % from August 2024.

First-time-buyer homes averaged £174,000, compared with £168,000 a year earlier.

Average price per square metre stands at approximately £2,500 for houses (≈ £232 per sq ft) and £2,000 for flats (≈ £186 per sq ft) – a strong reflection of local affordability and commuter appeal.

Prime & Lifestyle Markets – BL1 5, BL7 & BL7 0 (Heaton, Egerton & Edgworth)

These areas form Bolton’s high-end corridor, defined by detached family homes, top school catchments and lifestyle appeal.

• BL1 5 – Heaton & Markland Hill: Average sale price ≈ £315,000 (+3.8 %). Detached properties along Chorley New Road and Markland Hill Lane achieved £400k–£600k +, with prestige listings above £750k.

• BL7 – Bromley Cross & Egerton: Average ≈ £310,000 (+4 %). Family semis and detached stone homes often reached £400k–£550k +; proximity to Turton School and Jumbles Country Park keeps demand strong.

• BL7 0 – Edgworth & Chapeltown: Average £340k–£360k (+4–4.2 %). Character cottages and conversions range £500k–£700k +, while modern semis trade around £300k. Stock remains scarce, with homes selling quickly thanks to rural appeal and commuter access.

Together these postcodes represent Bolton’s premium tier, where quality and location underpin enduring value.

Upper-Mid Market – BL1 6 & BL6 (Astley Bridge, Sharples, Horwich & Lostock)

• BL1 6: Average ≈ £235,000 (+3.2 %). Popular 3-bed semis near Sharples School achieve £250k +, attracting upsizers from inner Bolton.

• BL6: Average ≈ £255k–£260k (+3.5 %). Detached homes near Middlebrook and Lostock out-performed; apartments by the station appeal to commuters.

Both areas continue to benefit from balanced pricing and strong local amenities.

Accessible Family Market – BL2 5 (Harwood & Breightmet Fringe)

Average value ≈ £225,000 (+3 %). Modernised semis and 3-beds remain the most popular choice for first-time buyers and growing families seeking value and good transport links.

Local insight from Newton & Co

Across Bolton data show resilience and confidence. Buyer activity has moderated but not stalled, with well-presented homes continuing to achieve strong results.

• High-end districts (BL1 5, BL7 & BL7 0) remain supply-constrained.

• Mid-market zones (BL1 6 & BL6) attract steady family movement.

• Affordable pockets (BL2 5 and parts of Bury) keep the ladder accessible for first-time buyers.

The overall picture: a calmer market built on stable pricing and realistic expectations — an encouraging foundation for 2026.

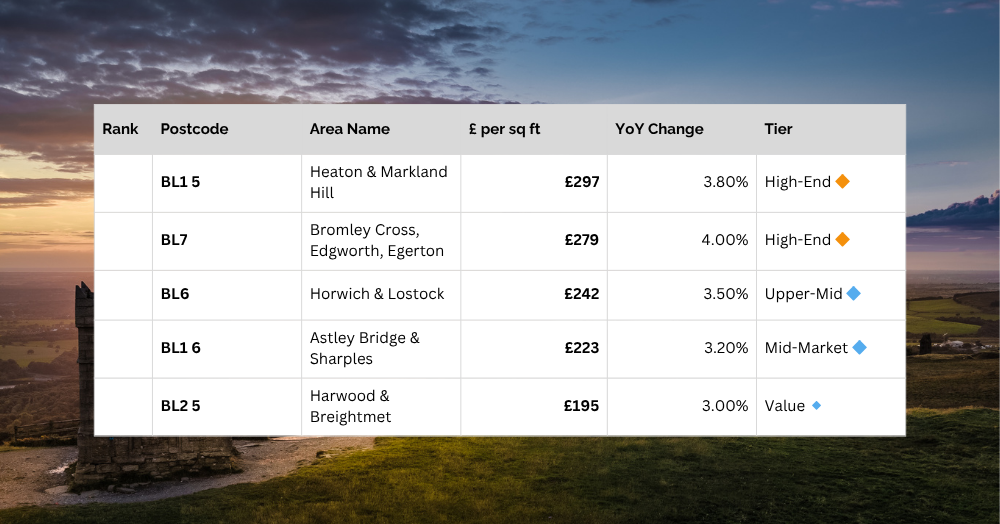

Brief: 2025 Bolton £ per sq ft by Postcode

Compiled by Newton & Co | Land Registry & Plumplot 2025

Key Lessons for Buyers, Sellers & Landlords

Buyers

- Affordability still matters. In Bolton & Bury, the lower price base gives buyers a better opportunity to step-up or move sooner.

- Be ready. With growth moderate, competition might be driven more by location and condition than just price rises.

- Running costs are becoming a bigger factor. Energy efficiency and maintenance matter in buyer decisions.

Sellers

- Presentation and pricing are now more critical than simply ‘listing early and waiting for offers’. With slower growth, pricing realistically attracts interest.

- Local strength in Bolton & Bury means sellers who prepare well and pick the right launch timing can still benefit.

- Energy-efficiency (EPC ratings, heating systems) can give a competitive edge.

Landlords

- Rental inflation is strong (e.g., 8.7% in Bury). This indicates demand remains high for well-managed rental stock.

- Winter maintenance, EPC compliance and tenant-communication remain priorities.

- When markets remain stable rather than explosive, long-term strategy and cash-flow matter more than short-term gains.

Predictions for 2026 – What to Watch

- Supply remains tight. The shortage of new homes continues to press upward on demand, especially in commuter zones and affordable regions.

- Mortgage & interest rates. Any cuts or improved borrowing options could stimulate the market. Watch for policy signals from the Bank of England.

- Regional strength continues. Regions like the North West (including Bolton & Bury) are likely to outperform the national average due to relative affordability.

- Energy efficiency & regulation. Expect increasing buyer/tenant expectations around green standards, EPCs and running-costs.

- Investor appetite may shift. As capital growth slows, investors may look more at rental yields, refurbishment opportunities, and value markets — rather than just relying on rapid price rises.

- Technology & process changes. Faster conveyancing, digital platforms and more transparency are improving buyer/seller experience and may drive greater activity.

What Newton & Co Expect Next

In the Bolton & Bury area, we anticipate 2026 will be a year of consolidation and opportunity rather than dramatic leaps in value.

- For sellers: well-prepared homes listed early in the year can capture motivated buyers and benefit from lower competition.

- For buyers: affordable markets like ours remain attractive — especially for first-time buyers and those upsizing with strong credentials.

- For landlords/investors: maintaining property quality, energy efficiency and tenant-relations will be key to securing returns in a steadier market.

Whether you’re buying, selling or letting — this is a moment to think strategically, not simply reactively.

Ready to Plan Your 2026 Move?

If you’re considering a move in 2026, now is the time to engage the team at Newton & Co. We offer:

Let’s position you ahead of the next phase – with local insight, tailored strategy and real-world results.