Getting mortgage-ready doesn’t have to be stressful. With the right preparation and guidance, you can go from curious browser to confident buyer.

Buying your first home is a huge step and getting your finances in order early will make the process smoother and far less stressful. Here’s how to get mortgage-ready before you start viewing.

Step 1: Know What You Can Afford

Start by reviewing your income, savings, and monthly spending to understand your realistic budget. Most first-time buyers aim for a 10% deposit, but some lenders offer mortgages with as little as 5%, depending on your circumstances.

It’s also a good idea to look at all the costs involved, not just your deposit. This includes solicitor fees, survey costs, moving expenses, and stamp duty (if applicable). Having a clear picture of your full budget will help you make confident decisions later.

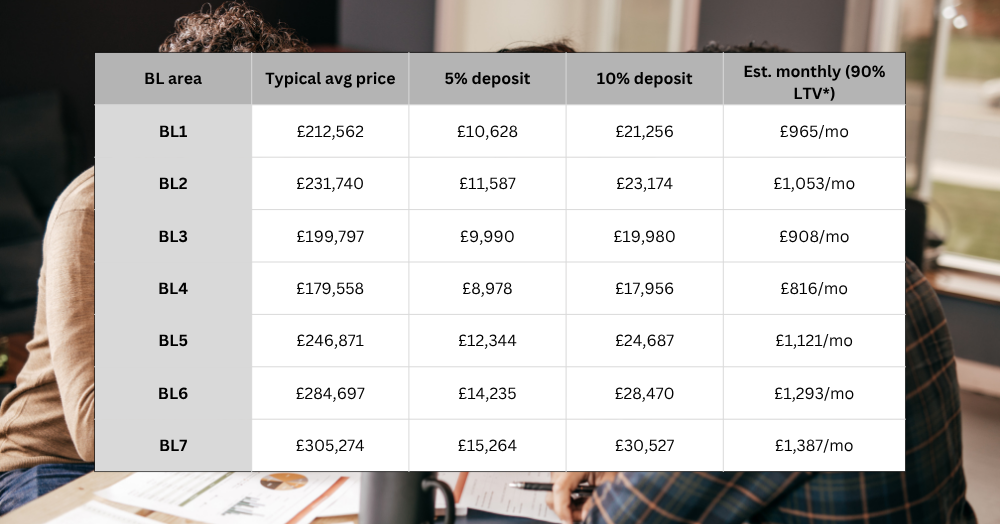

Here’s what a typical average buyer budget looks like across the Bolton postcodes (BL1–BL7):

These figures are based on recent average sold prices (Rightmove, 2024–2025) and show what a 5 % or 10 % deposit might look like in each area. Actual affordability will vary depending on your lender and circumstances

Step 2: Get a Mortgage in Principle

A Mortgage in Principle (sometimes called an Agreement in Principle or Decision in Principle) is a document from a lender showing how much you might be able to borrow based on your financial situation.

It isn’t a full approval, but it’s a powerful tool, it helps you understand your buying range and shows sellers and agents that you’re a serious buyer. Having this ready before you start viewing can even make your offer more attractive once you find the right home.

Step 3: Gather Your Documents

Lenders and solicitors will need to see proof of who you are and how you earn your income.

You’ll usually need:

- Photo ID (passport or driving licence)

- Proof of address (utility bill or bank statement)

- The last three months’ payslips (or accounts if you’re self-employed)

- Recent bank statements showing your savings and spending

Having these ready early on can save a lot of time once you find the home you want.

Step 4: Work with a Trusted Mortgage Partner

We can introduce you to a friendly, experienced mortgage advisor who will guide you through the process, explain your options clearly, and help you find the best rate and lender for your circumstances.

They’ll also help you understand which mortgage products you’re eligible for, what your repayments might look like, and how to make your application as strong as possible.

💡 Pro Tip: Even if you’re not ready to buy today, speaking to a mortgage expert early gives you a clear plan for your savings and timeline and puts you in a stronger position when the right property appears.